Hotel industry to get Partial Relief in GST

HRAWI welcomes The Revision, but maintains that the structure continues to be un-competitive vis-à-vis neighbouring countries.

The Hotel and Restaurant Association of Western India (HRAWI) has welcomed the revised GST slab on hotel room tariffs that effectively widens the tax slab of 18 per cent to tariffs ranging between Rs.2500 and Rs.7500 instead of the previous upper limit of Rs.5000. With the revision, the highest tax rate of 28 per cent is assigned to tariffs of Rs.7500 and above. Although the hotel industry was hoping for a more competitive and simpler GST, it has welcomed the partial relief. Along with the revision in the slabs for room tariffs, the tax rate for air-conditioned restaurants including restaurants in 5 star hotels will have GST at 18 per cent, effective July 1, 2017.

“This is unarguably a welcome revision. But, if India has to remain competitive as a tourist destination, this may just not cut the ice. While neighbouring countries pay 5 to 12% GST or equivalent tax, hotels in India would be levying 18 and 28% GST. This may not augur well with foreign inbound tourists who are lured with significant deals and sops by our neighbours. We should remember that we are living in a very competitive world, and tourists today have a lot of choices,” says Mr Dilip Datwani, President, HRAWI.

It has been HRAWI’s contention that tourism is the one industry that has unlimited potential for job creation and forex earnings. With a more pragmatic taxation policy, the exchequer could stand to earn three times current earnings by increasing the base.

“So while the revision will provide hotels and restaurants some relief, we believe that the GST continues to be unviable even now. India needs to be not just promoted as a tourism destination but also needs to offer value for money to tourists. With countries around us levying taxes that are effectively half of our GST rates, in the long term the tourist inflow is bound to suffer. We are still hopeful that the Government reconsiders the GST for hospitality after they asses the results on the sector, post the roll out,” he concludes.

You might also like

The Nairobi Serena Hotel to reopen on Sept 1 after refurbishment

Nairobi Serena Hotel is pleased to announce the completion of the phase one of its ongoing refurbishment that will beopen from 1st September 2018. The refurbishment program is in line

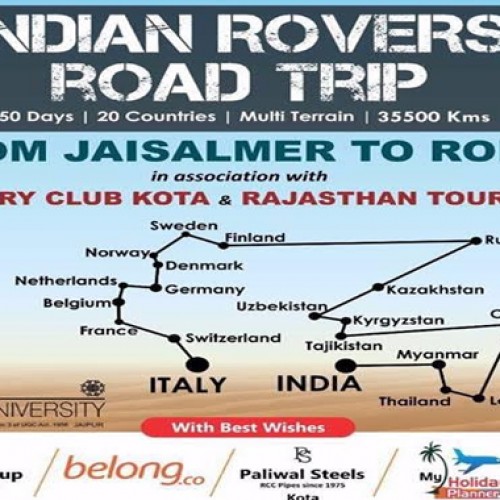

Come be a part of the multi terrain adventure with the Indian Rovers- A 33500 KM road trip of 150 days from India to Italy

What happens when 4 like-minded individuals decide to go on a journey of their lifetimes? It results in an adventure that millions wish to take. A road trip from India

International Homestay and Rural Tourism Travel Meet in Kochi

Kerala Tourism will organise the second edition of the International Homestay and Rural Tourism Meet in Kochi from September 15. The three-day event, scheduled to be held at Bolghatty Palace,